This article is an overview of my presentation at the inaugural Accounting Business Expo: "Why Advisory won't save you from technology".

A Consensus View

Everywhere you look, it seems the world is telling accountants that compliance work is a non-growth future (at worst a dramatically diminishing business, brought to an end by government policy and technology). The answer, according to pretty much everyone, is operational advisory - helping clients with running better businesses. An entire industry has popped up to coach and help accountants "transition from compliance to advisory". Technology has popped up everywhere, to systemise advisory, with report packs and standardised approaches for how you monetise the "enormous, under-serviced, advisory opportunity".

Is "Advisory" Really The Panacea?

After spending 17 years in the accounting tech and "business advisory" space, and the last few particularly focused on the future of technology, a number of aspects of the consensus push towards advisory has been troubling me. And if you've ever read "The Black Swan" by Nassim Taleb or "Outliers" by Malcolm Gladwell as I have, you'll understand why I'm a little sceptical, as they more eloquently than I can, explain that it is outliers, not consensus views that ultimately win out. If everyone saw Facebook coming, why was it only Zuckerberg that cracked it? The reality, few saw Facebook coming, it was an outlier and that is at the core of why it has been a success!

Concern 1: How far does the accountant's trust position really extend?

The basis of the consensus push towards advisory, is Accountants in practice have a unique and strong trust position with their clients - small business owners. Technology and Service providers have long cottoned on to the aggregation channel accountants offer them. If they can "get in" with the accountant, the "trilogy of trust" is such that "if my accountant trusts this is the right solution for me, then it must be".

There is no doubt, accountants are trusted for their knowledge of accounting and taxation compliance. As a doctor is trusted for their prescribing of medicines. But would you trust a doctor for their stockbroking advice? Whilst we might trust a pilot with our lives, every time we hop onto an aeroplane, would we trust a pilot to draw up the plans for a new house? My concern is where does the sphere of trust that an accountant in practice has with a client extend?

One accountant once bragged to me that if he told his clients to get Foxtel at home, they would, without questioning him why...really?

From my experience as the client of accounting firms and as an advisor to SMEs on operational efficiency, I struggle to see that the majority of clients will seek out, nor trust their accountant to tell them how to run a better [insert industry here] business, too far beyond compliance. I have the feeling that genuine, operational advice is beyond the sphere of trust that most accountants in practice have with their clients.

Concern 2: Advisory Is Where Everyone Is Heading

Convergent Evolution is described by ScienceDaily.com as being: “the process whereby organisms not closely related (not monophyletic), independently evolve similar traits as a result of having to adapt to similar environments.”

Sharks are fish. They have evolved over millions of years from other ancestral fish who were always water-bound.

Dolphins are mammals. They evolved over millions of years from land-bound quadrupeds, somewhere along the lineage, taking back to the ocean from whence they distantly evolved.

Biologically, sharks and dolphins are very far apart (in fact more distantly related than a crocodile is to a chicken!), they are NOT monophyletic. Yet over millions of years they have independently evolved similar traits (similar body shape, fins, tails, colouring etc) as a result of having to adapt to similar environments (life in the ocean).

So herein lies the crux of my concern: a slew of different industries around the white-collar, B2B professional services sectors, each with their own historical barriers to entry, are independently evolving similar traits as a result of having to adapt to a similar environment. An environment of digital transformation. Each is seeing technology driving disruption to traditional business models, empowering end-consumers and changing the way services are delivered.

Accountants, Bookkeepers, IT Service Providers, Software Consultants, Business Coaches, Management Consultants, Insurance Brokers, even Banks – basically any service provider to SMBs, are faced with the prospect of rapidly evolving their business models or face the distinct possibility of being left behind, even extinction.

What we are witnessing is the emergence of similar solutions to similar problems across industries, tearing down barriers that once existed between industry sectors and driving a degree of homogenisation of service offerings. And do you know the most popular new service offering? Advisory...

So, accounting firms are not just competing against other accounting firms in offering Advisory services. They are competing with an array of service providers, all vying to offer advisory services to SMEs. If anyone has read "Blue Ocean Strategy" by Kim and Mauborgne, Advisory services is undoubtedly a "Red Ocean" strategy. Highly competitive, ultimately price sensitive "blood bath". Not a market condition I personally want to be running towards in blind faith that it will grow and even survive my company.

Concern 3: The More You Commoditise Advisory, The More Likely It Will Be Automated

The solution offered by many to help accounting firms scale advisory, is to systemise advisory to the point that junior staff can start to provide operational advice to clients. That is all well and good and on the surface, scaling advisory services is the challenge for every firm. But consider this, if you manage to systemise a service to the point junior staff can deliver the solution, are you not but one step away from completely automating it? And if you haven't been the one to develop the system yourself, are you not but a channel to market, that once established, doesn't need a middleman?

Concern 4: Where Is The Future Of Accounting Tech?

I've been lucky enough to travel the world over the past couple of years, deeply investigating the future of accounting tech. Outside the content you may have found in my blog are reports and deep dive studies paid for by others (and thus owned by them), that study and try to predict the future of the accounting technology industry. The impact that technology will have on the existing accounting profession, will be profound. Many a smarter individual (and collective) than I have published studies to this effect (McKinsey, Susskind & Susskind, Carl Benedikt Frey and Michael A. Osborne at Oxford University are but 3).

Some of my major observations include:

The big whales are sucking up all that data

When people talk cloud and its impact on accounting tech, often the centralised data collection point is overlooked. Intuit are close to announcing 2m online subscribers. Xero are close to announcing 1m.

By way of example, Xero now have around 1/3rd of all businesses in New Zealand using their platform, trading with the other 2/3rds. They know more about what is going on in the NZ economy than anyone else. They know more than the banks. More than the IRD. More than any other service provider. What they can do with that data is mind-boggling! And this is where Machine Learning and Artificial Intelligence has far greater capability than any human. The ability to analyse masses of data and draw correlations and conclusions from "whole of population sampling" will change the very idea of advice (and kill off any value of random sampling) and challenge the limited sphere of experience that any one person may gain in their career.

This in and of itself, challenges the very definition of advisory services and how a "channel to market" might compete with the power of the technology and data owner.

Consider the world's 3rd largest cloud accounting tech company

If Intuit and Xero have the broadest penetration of SMEs genuinely using their cloud accounting technology, do you know who the third largest is? By my reckoning it would be Visma. What's that, you've never heard of Visma? They own Scandinavian accounting tech, with north of 400,000 businesses on their cloud accounting platforms. They are so big, the Swedish Competition Commission recently blocked their attempt to acquire their last remaining, genuine competitor.

Apart from being owned by VC, do you know what is unusual and possibly scary about Visma? They are in fact both an accounting technology company AND an accounting firm...

Does this hint to a future business model for some of the other big whales? Acquisition of / merger with major accounting firms? What implication does that have? What value would a suburban accountant offer in the advisory space with their competitor owning the technology and the data?

Are Accountants Another Example Of An Uber Driver?

Drivers have been core to Uber's worldwide expansion. It's a two-sided marketplace and you wouldn't be able to get the customers without the drivers on the road. The drivers are happy, they have a new revenue stream. Customers are stoked the taxi industry has been shaken up. Seriously Cab Charge, 10% credit card fees - you brought this upon yourselves!

But what is Uber's long-term play? Look at what's been happening in Pittsburgh! Uber doesn't need drivers, they just need the cars to drive themselves (where Uber develop them or not)! In effect, Uber drivers are a short-term necessity to build market share, to be replaced in the future by cars that don't need them (which raises the question, who will own the cars? Uber couldn't possibly raise the capital to buy all the driverless cars they will need in all the cities in the world, straight-away, so car owners will become of the "channel to market" of tomorrow).

Anyway, my point of comparison here, is a question about Advisory services. Are accountants merely a channel to market that may not be needed once the market is established and the players develop the relationship with the end customer?

Conclusion

I remain decidedly unconvinced that operational advisory is the future of the accounting industry. Not just because I'm the guy who will go right just because everyone else is going left (and I am that guy). But because I'm taking the time to consider the flaws in the consensus view. Something I am seeing few (outside perhaps Paul Meissner at 5-Ways) really turn their minds to. Remember, its the outliers that change the world, not the sheep that follow the leader!

So what is the alternative to operational advisory?

Rather than just question the consensus view, I made it my mission to hunt out the black swan. The outlier that no-one else is talking about, that will seem so obvious in hindsight. It was whilst I was undertaking the Australian Institute of Company Directors (AICD) - Company Director's Course last year that I had a light bulb moment. Who is talking to SMEs about this stuff?

It started with the compliance elements. Did you know Directors by law in Australia, must:

Act in good faith and in the best interests of the organisation

Act with care and diligence

Be financially literate (and as the Centro case proved in 2007, NOT rely on others (like their external accountants) for financial judgement - I found this a great fact sheet on the case)

Aware of their duties

Ensure the organisation is able to pay its debts on time

Identify risks to the organisation

Monitor performance

Manage conflicts of interest

Surely, I thought to myself, this stuff IS within the trust sphere of the relationship an accountant in practice has with their clients?

Upon completion of the course, I wondered, why was no-one talking about Governance consulting as the future of the accounting profession? Is this the Black Swan? Something SO obvious in hindsight, but until it arose, just an outlier to the prevailing model?

Is Governance A Blue Ocean Opportunity For Accounting Firms?

The market opportunity seems large

There are 600,000 Not-For-Profits in Australia (according to the Productivity Commission). Most of whom run formal board structures.

According to the Family Business Council family business accounts for 70% of all business in Australia and 34% of those already run formal board structures (that equates to ~500,000 boards by my reckoning and another 1m odd without boards - which also can be seen as a major opportunity).

As for succession planning, surely governance is the answer for increasing multiples? Extracting strategy, risk and change oversight from an individual business owner or tightly held executive directors structure and creating an oversight "board" seems to me like a logical step. And have you considered the size of the "baby boomer succession opportunity"? Did you know, again according to the Family Business Council the average age of business owners in Australia is 55. 61% would seriously consider selling if approached and 44% are actively planning to sell.

There are few competitors and it is under-serviced

Outside the Big 4 (who've never managed to scale into the SME space), Governance consulting is the bastion of "lone-wolves", deeply experienced consultants, who are generally in high demand. According to a Robert Walters study, they are in such high demand, that despite an economy recording little to no real wages growth, Governance Consultants will enjoy "double digit wages growth in 2017".

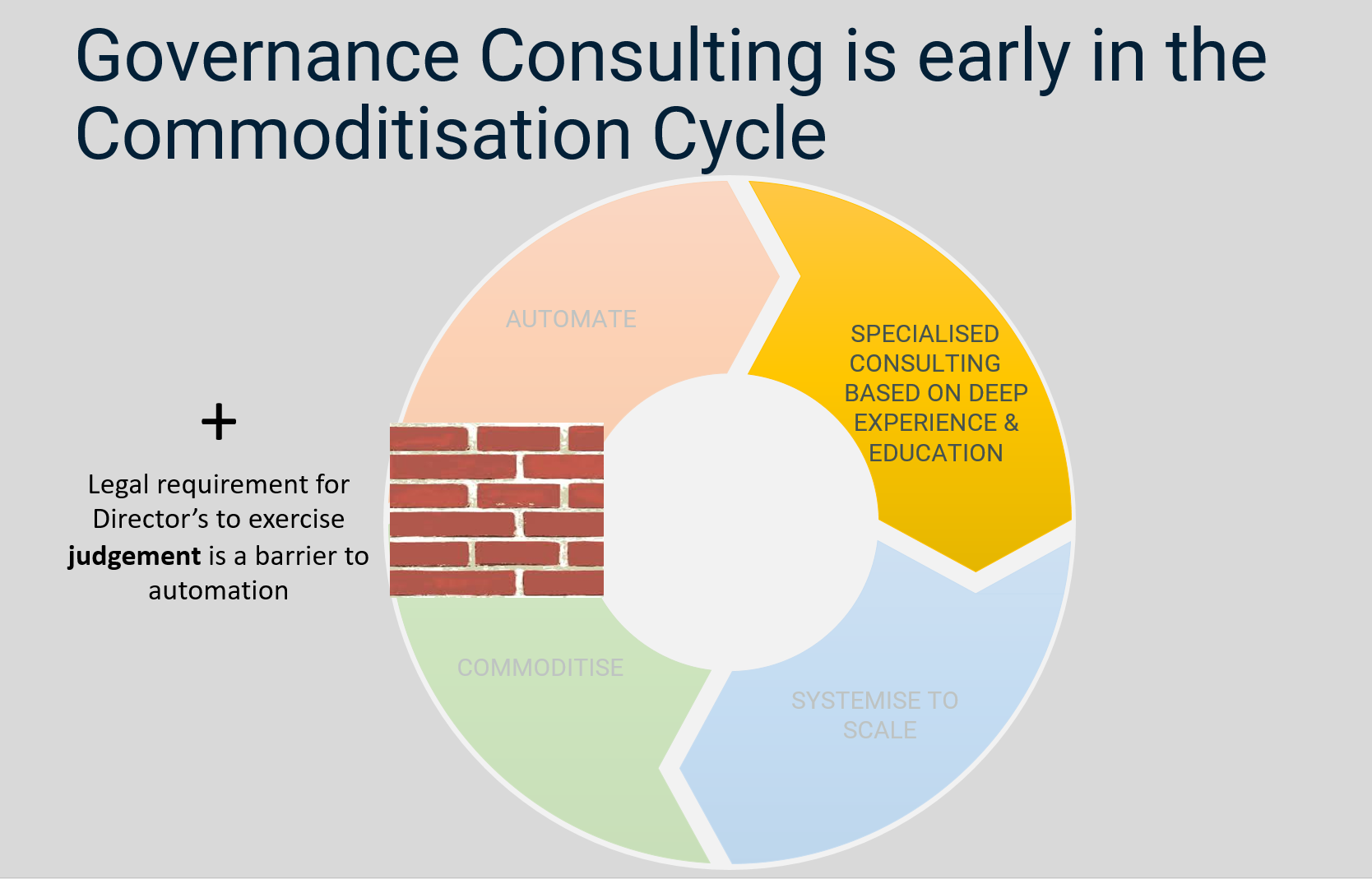

Governance is earlier into the commoditisation cycle and has a legal blocker to automation

Governance is a far less mature "offering" to operational advisory services, which extends the horizon on commoditisation, and increases the value of the service. The legal requirement for directors to exercise judgement, also provides a significant blocker to governance consulting ever being automated out of existence.

My Remington Moment

Do you remember the Remington shaver ad from way back when? "I loved the shaver so much I bought the company?". Well in the last few months, I had my Remington moment, well kind of.

I have been so convinced by the Governance opportunity, I set on a personal mission to look for the technology opportunity in the space. Being set up at Fishburners (one of Australia's leading startup hubs for technology), I was entertaining a crack at building my own Governance application. In the process of investigating the market, I sort out the council of one of Australia's leading Governance experts, Simon Neaverson FAICD, only to find, Simon had identified this opportunity long ago and set about leveraging technology to ride the Governance wave he saw coming with his own governance platform GovernRight (www.governright.com.au).

And that brings me forward to today. I am so sold on the opportunity for accountants to ride the governance wave, I've now switched my focus from accounting tech, to governance tech. I'm now invested in it! Taking on the role of Director of Partnership at GovernRight, I've jumped right in. I've seen the light. I'm convinced. I'm in. I'm putting my money and my time where my belief/mouth is.

If I've piqued your interest. Contact me, let's discuss the opportunity:

Domain Expertise + a Governance Framework (GovernRight) = Governance Consulting = Opportunity!